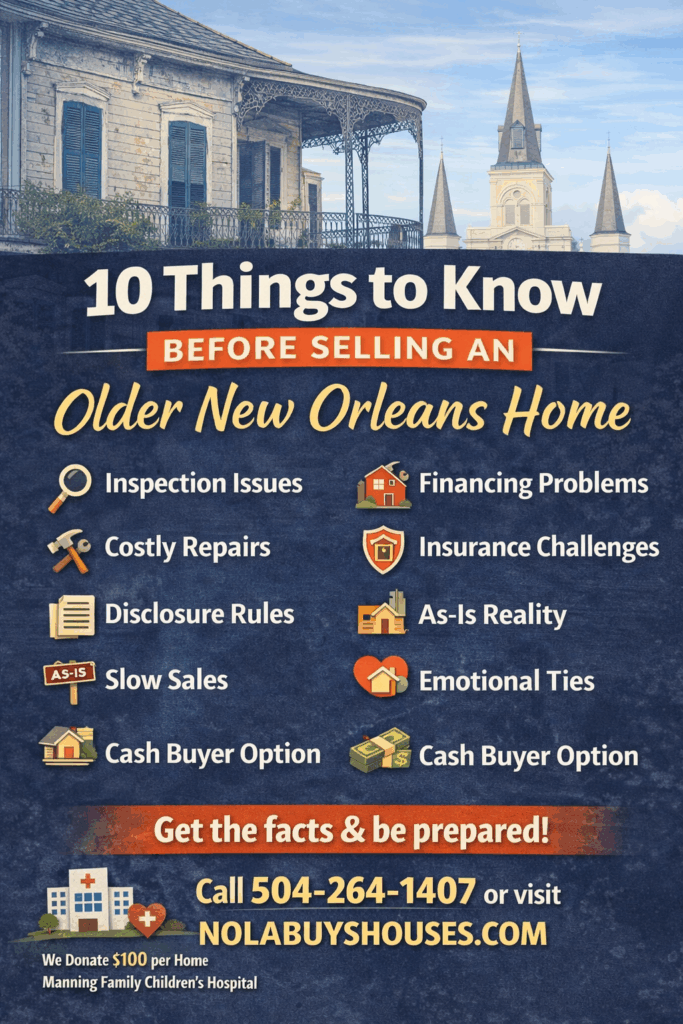

Selling an older home in New Orleans is very different from selling a newer house in most other cities. The charm is very special — high ceilings, original wood floors, solid construction — but older homes come with things that can complicate a sale if you’re not prepared.

I’ve been buying houses across the New Orleans metro area for over 20 years, and a large percentage of the homes I see are 50, 75, or even 100+ years old. Before you decide how to sell, here are ten important things you should understand.

1. Inspections Matter More with Older Homes

Older homes almost always raise red flags during inspections. That doesn’t mean the house is “bad,” but it does mean buyers and lenders will have concerns.

Common inspection issues include outdated wiring, plumbing problems, foundation settling (very common around here with the soft ground), roof age, moisture intrusion, and termite damage. Even things you’ve lived with for years can become deal-breakers once they’re written down in an inspection report. And oftentimes things don’t need to be that bad in order to need updating. Like electric for example. If your electric in your house is working fine, are you going to rewire the whole house, of course not! But for a new owner who is making a new and very large financial decision, and plans on living in the house for 10 or 20 years or more…they’re going to want outdated electrical changed out and up to code.

2. Financing Can Be a Major Obstacle

Many older homes struggle to qualify for traditional financing. Lenders are conservative, and if they see safety or structural concerns, they may refuse to fund the loan — even if the buyer wants the house. Same thing, the lender wants to lend on safe investments. If there are structural repairs that need to be done, they don’t want to leave that up to inexperienced people to handle the fix. Nor do they want to lend on a house with wiring that is 3 generations old and doesn’t meet today’s code.

This is one of the most common reasons older homes fall out of contract.

3. Repairs Cost More Than You Expect

Repairing an older home is rarely simple. Once work starts, contractors often uncover additional issues behind walls, under floors, or in crawl spaces.

What starts as a “small repair” can quickly turn into a much larger expense — and timelines tend to stretch out longer than expected. Let’s say yo are rewiring the house, you open up the wall and surprise…termite damage!

4. Insurance Is a Bigger Issue Than Ever

Insurance companies are far more selective than they used to be, especially with older properties. Roof age, electrical systems, plumbing materials, and past claims can all affect insurability.

If a buyer can’t get insurance, they can’t get a loan — and the sale stops.

5. Disclosure Rules Still Apply

If your house goes under contract and then falls apart due to inspection issues, those problems usually need to be disclosed to future buyers.

This often makes the second (and third) sale attempt more difficult than the first.

6. “As-Is” Doesn’t Mean No Problems

Selling a house AS-IS that needs repairs is very important. We always buy houses as-is and waive redhibition. But many sellers think listing a house “as-is” protects them from repair requests. In reality, buyers can still inspect, negotiate, and walk away.

“As-is” does not remove inspection concerns — it just limits your obligation to fix them and any recourse after the sale is complete.

7. Older Homes Take Longer to Sell Traditionally

Even in good markets, older homes often sit longer than newer properties. Buyers today want move-in ready homes, especially with interest rates and insurance costs where they are.

More time on the market usually means more price reductions and more stress.

8. Emotional Attachment Can Complicate Decisions

Older homes often carry decades of memories. Families grew up there. Life happened there.

That emotional attachment is completely normal — but it can make selling harder, especially when buyers start pointing out flaws. It’s important to separate memories from market realities.

9. Selling As-Is to a Cash Buyer Is a Real Option

For many owners of older homes, selling as-is to a local cash buyer makes the most sense.

This option allows you to:

· Skip repairs

· Avoid inspections and appraisals

· Close quickly

· Sell the house exactly as it sits

You don’t need to modernize the home or bring it up to current buyer expectations.

10. Local Experience Makes a Big Difference

Not all buyers understand older New Orleans homes. National companies often underestimate repair costs, misunderstand local construction styles, or back out once problems surface.

Working with someone who knows the area, the houses, and the common issues can save you time, frustration, and surprises.

A Note About Giving Back to the Local Community

One thing I’m especially proud of is that for every home we purchase, we donate $100 to the Manning Family Children’s Hospital. Over the years, those donations have added up to more than $10,000, and we’re committed to continuing that mission.

Helping homeowners move forward while also supporting the community matters to us.

Conclusion

Selling an older New Orleans home doesn’t have to be overwhelming — but it does require realistic expectations and the right strategy.

Whether you choose to make repairs, list traditionally, or sell as-is, understanding these ten points will help you make a decision that fits your situation and your goals.

If you’d like to talk through your options or get a no-obligation cash offer, I’m always happy to help. Give us a call at 504 264 1407 or head to our website www.nolabuyshouses.com